This lifetime cap means that if you ve claimed at least 500 in credits in the past you won t be able to claim credits again in 2018 if congress renews the credit.

Irs energy efficient tax credit 2018.

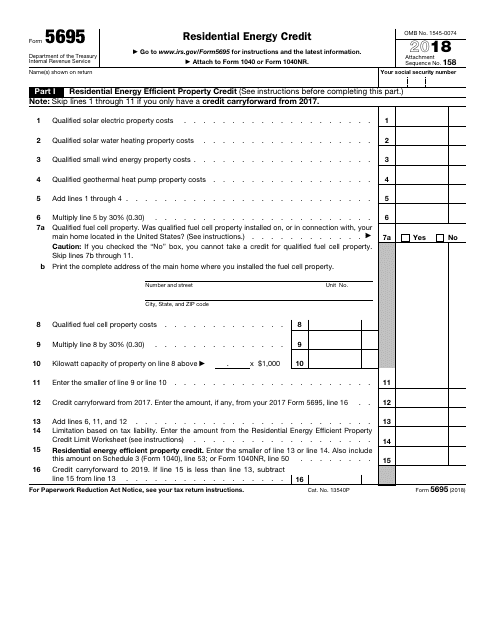

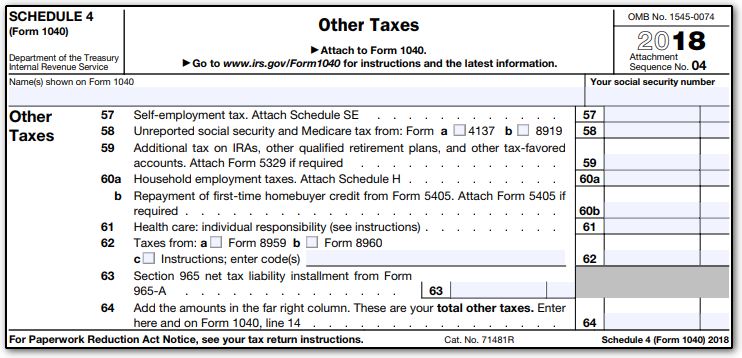

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

This includes the cost of installation.

150 for any qualified natural gas propane or oil furnace or hot water boiler.

And 300 for any item of energy efficient building property.

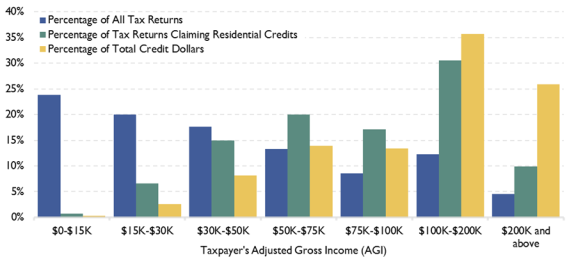

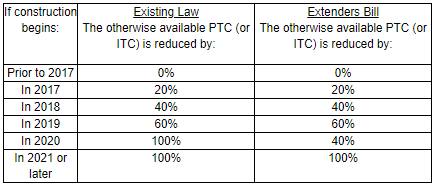

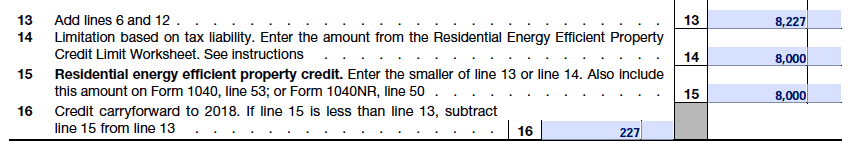

Residential energy efficient property credit this tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

Form 8908 pdf information about form 8908 energy efficient home credit including recent updates related forms and instructions on how to file.

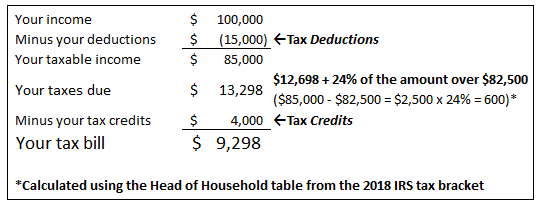

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

A credit limit for residential energy property costs for 2018 of 50 for any advanced main air circulating fan.